Canadian real estate went from being a boost for the economy, to being a drag in just over a year.

Statistics Canada (Stat Can) data shows real gross domestic product (GDP) fell in May. Amongst the sectors causing the slowdown was the Canadian real estate market, having peaked in March. Since then the sector has been deteriorating at a faster rate than the general economy.

Canadian GDP Falls For A Second Consecutive Month

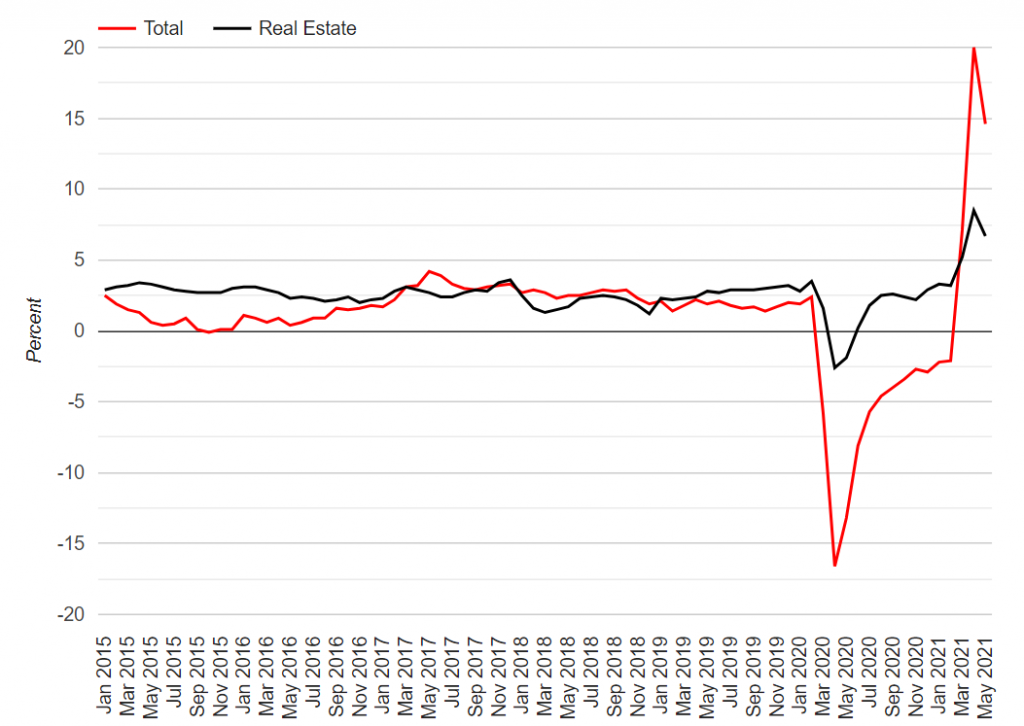

The overall picture for Canadian GDP suffered some setbacks in the latest data. Stat Can reported an 0.3% decline in May, which followed an 0.5% decline in April. The economy remains 2% lower than February 2020, pre-pandemic. Third wave restrictions are the biggest contributor to the decline, but not the only one. Real estate, which bucked the trend during lockdowns, pulled back from record activity.

Canadian GDP Growth

The 12-month change in Canadian real gross domestic product (GDP), and the GDP component Real Estate Rental and Leasing.

Real Estate Makes The First Back-To-Back Drop Since April 2020

The Real Estate, and Rental and Leasing component of GDP is finally starting to cool down. The sector contracted by 0.4% in May, following an 0.8% decline in April. It was the first back-to-back drop since March-April 2020, said Stat Can. It also happens to be when existing home sales peaked in both Canada and the US.

The decline in the output of offices of real estate agents and brokers was a big part of the drop. This sub-component saw activity fall 7.2% in May, following a 10.7% drop in April. It’s now back to July 2020 levels, which is still very busy. It’s just not scorching hot, consuming-the-economy types of busy.

Real Estate’s Contribution To GDP Is Shrinking, But Still Huge

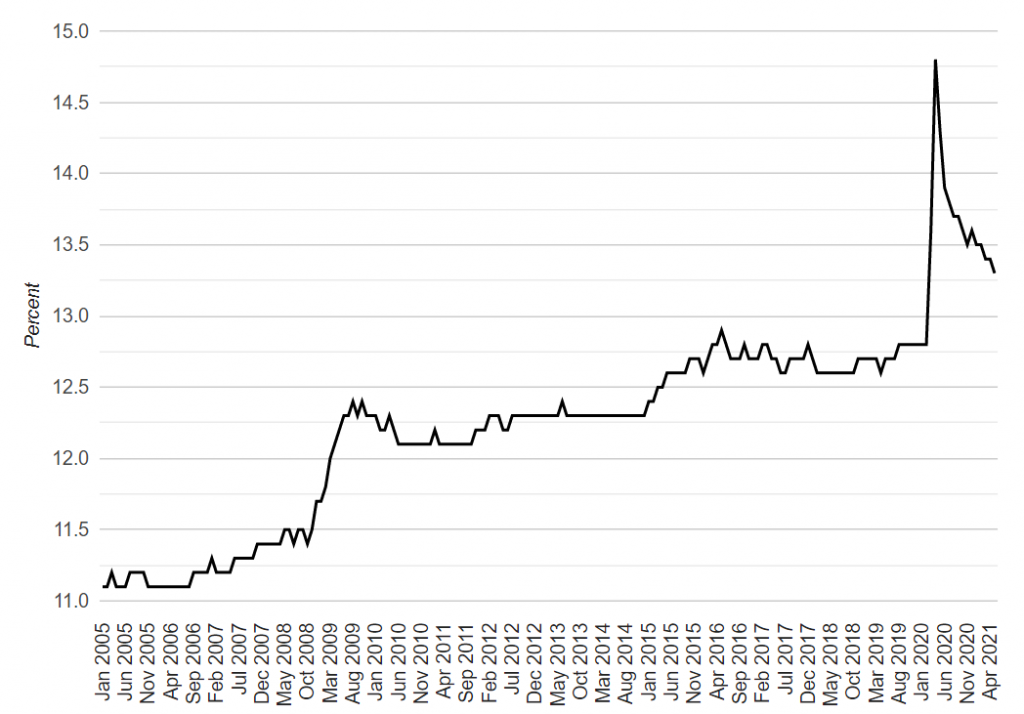

Canadian real estate had been consuming more of the economy, and it’s starting to roll back. At least, closer to its pre-pandemic share of the economy. Real Estate and Rental and Leasing represented 13.3% of GDP in May. The sector peaked at 14.8% in April 2020, and was 12.8% in February 2020, pre-pandemic. Pre-pandemic levels of GDP from real estate were already considered overly dependent. A return to these levels won’t make the market “healthy,” but it’ll be the beginning of rebalancing.

Canadian Real Estate As A Share Of GDP

The share of Canadian real gross domestic product (GDP) represented by real estate rental and leasing.

GDP is pulling back, with a large share of the drop due to temporary lockdown restrictions. That should bounce back fast, but spending won’t always appear in the same sectors. For example, you’re probably not getting two haircuts to make up for lost time. You might spend that money on an extra meal out, or stash it in savings though. Part of the restrictions have already been lifted, and should show up in the next set of numbers.

Real estate is seeing a similar pull back, but it’s different from the general economy. During the prior lockdowns, home sales didn’t skip a beat, pushing to record activity. Now we’re seeing a decline more in-line with pulled-forward demand catching up. Home sales are still busy, but at a more natural level of activity. The drop in general GDP is likely temporary, but the drop in real estate is more likely normalization.