Guest Blogger Eric Sabatini is a Mortgage Broker TMG The Mortgage Group, he shares his insights on the recent interest rate changes, how to put it into perspective, and how to prepare for the near future.

Just as we anticipated, another increase for the Bank of Canada (BOC) Overnight Rate. The rate increased by 75 BPS, which is an increase of 0.75%.

What does this mean for Prime Rate? Well, most people don’t realize that the BOC Overnight Rate & Prime Rate are not the same thing. However, Prime tends to go up and down with the Overnight Rate changes.

So within a day or two, most lenders will have updated their Prime rate to reflect the recent increase of 0.75%.

The Impact Prime Mortgage Rate has on Mortgage Products

Fixed Rate Mortgages = Everything remains the same, no change in payment.

Adjustable Rate Mortgages = Your payment will increase according to the Prime Rate. You will likely receive a letter in the mail outlining your payment increase amount.

Static Variable Rate = Your payment will stay the same, but the portion of interest paid to the lender will change.

If you’re in a Static Variable Rate Mortgage, it’s important to talk to your mortgage expert about your “Trigger Rate”. A Trigger Rate is when your whole payment becomes interest and no principal is being paid off, the lender will need to adjust your payments accordingly.

Even though your payment doesn’t change with a Static Variable, it’s still a good idea to manual change it yourself. Why? If you want to keep paying down your mortgage and not stretching out your amortization, you’ll want to increase your payment as Prime increases.

Forecasting

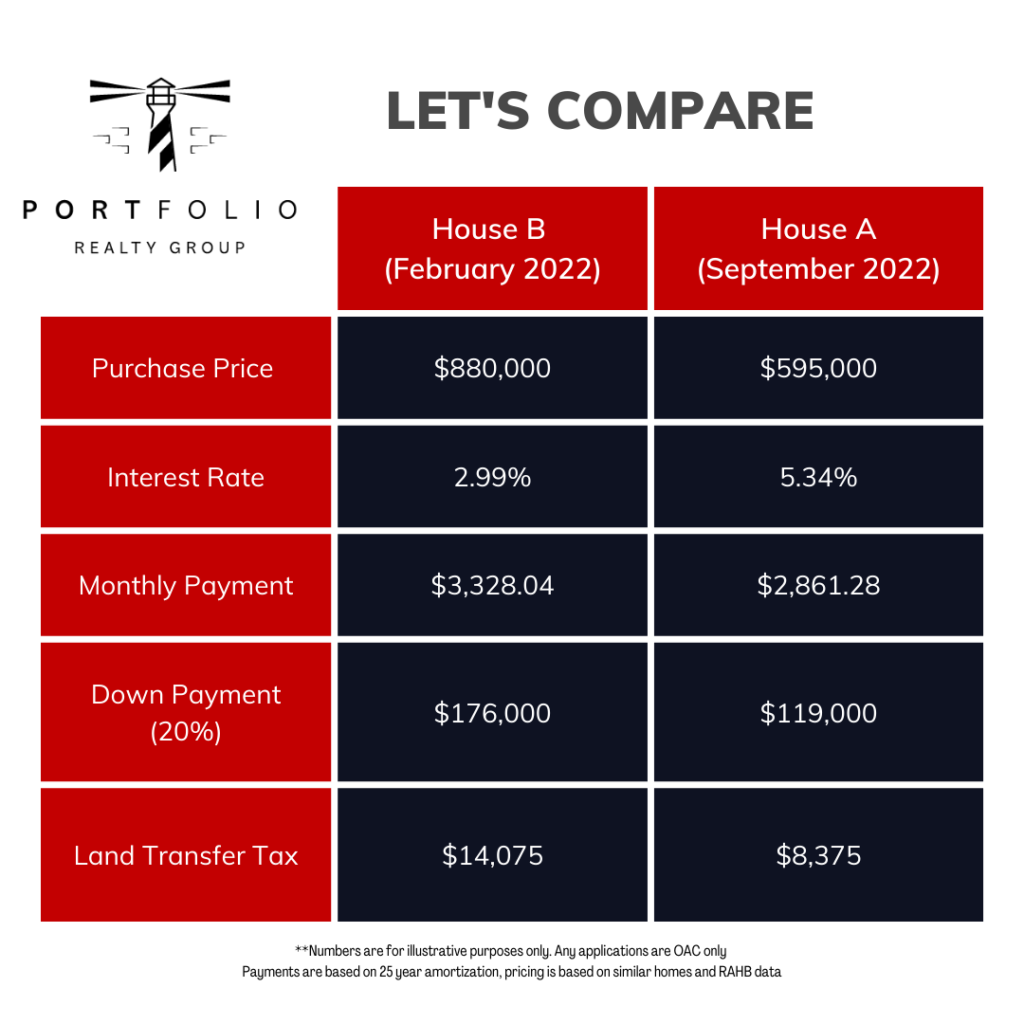

We need our clients to understand that rate is merely one aspect of the real estate game. Committing to the house does not mean committing to the rate, long-term. If history is a guide, locking in long-term is not advisable at this point — for anyone other than the most risk-averse borrowers.

Smart homeowners always look for a better financing opportunity, and make the move when the time is right. We can always change financing to more favorable terms later, should better rates and products become available. And if rates only get worse, then clients will be glad they married the house when they did.

Inflation is hot and central banks around the world are dealing with same interest rate pressures as we are. Our clients need to hear from us that these things happen, that what goes up will eventually come down. It’s also important for us to encourage our clients to look at personal spending and find areas to “cut” during the tough times.

When it comes to rate, especially variable rates, clients may be reaching out to complain that they have one or regret not taking that fixed rate when they had the chance.

Rate is about the entire term, often 60 months, not the 12 or 24 months where times were tough. If history is any indicator, as it almost always is, variable rate borrower could still likely save more interest over the duration of their entire mortgage term.

What clients also forget is that variable rates have fluctuations at times, but also allow for flexibility and lower penalties if mortgages are broken before their term is up. Fun Fact – 7 out of 10 borrowers break their mortgage within the first 36 months.

Bottom Line: tough times don’t last but tough people do.

We will get through these tough times and we will navigate the course as best we can. Let’s buckle up for another rate increase on October 27th with the knowledge that rate hikes will be coming to an end sooner rather than later. Until then, let’s educate, support, and guide. We will find better rates, better opportunities, and more advantages cash flow positions in the future. For now, let’s find some great real estate deals and date those rates for a couple years. Then, kick’em to the curb for a better one.

If you have any questions, reach out to Eric at [email protected] or visit https://www.mymortgageniagara.com/